Iran Pistachio Report

AUGUST 2025

Table of Contents:

- Iranian Pistachio Export Trends

- 2024 Current Crop Overview

- 2025 New Crop Forecast

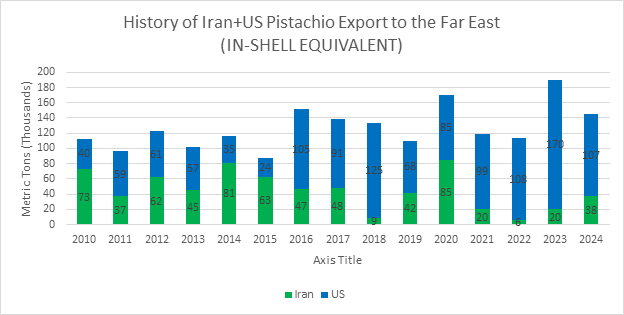

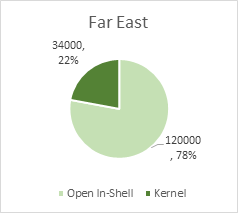

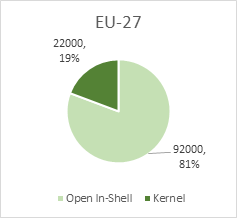

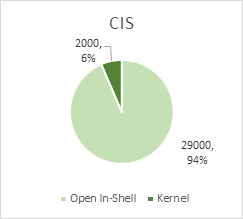

- Pistachio Export to the Far East

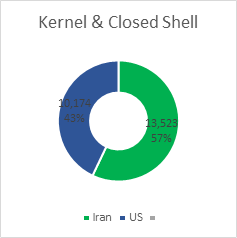

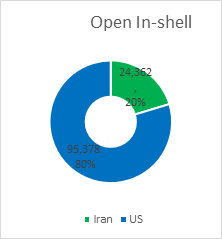

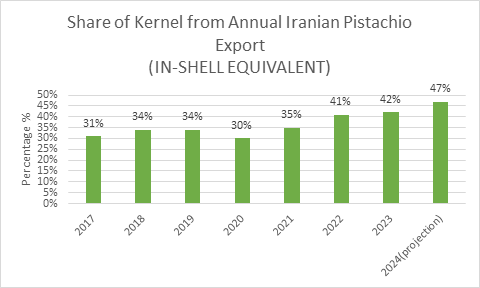

- Pistachio Kernel Boom

- Future Trends

- Opportunities & Challenges

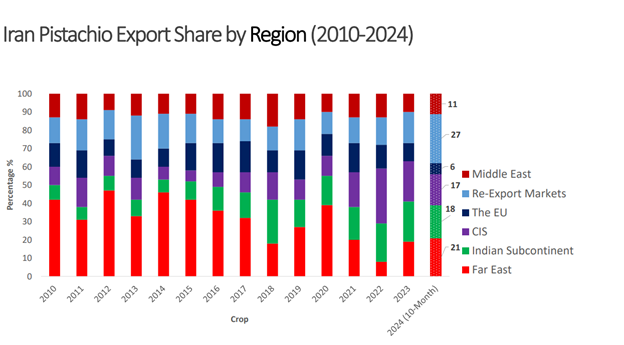

Iranian Pistachio Export Trends (Share from Total)

- Open Inshell Pistachios

- Closed Shell Pistachios

- Artificially Opened Pistachios

- Green Peeled Pistachio Kernels (GPPK)

- Pistachio Kernels

- Pistachio Oil, Paste, etc.

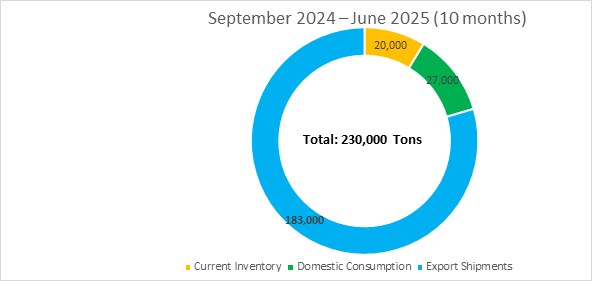

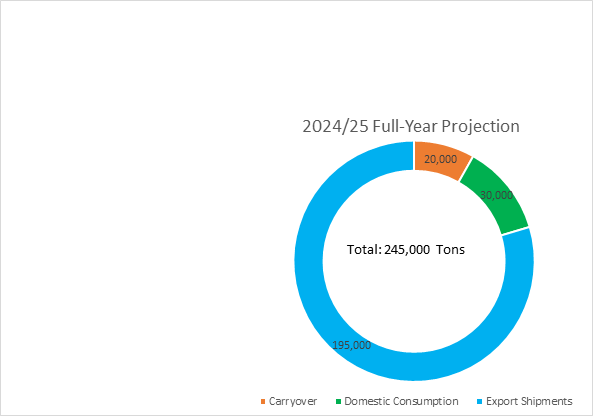

Iranian Pistachio Inventory / Shipment Report in Tons

(IN-SHELL EQUIVALENT)

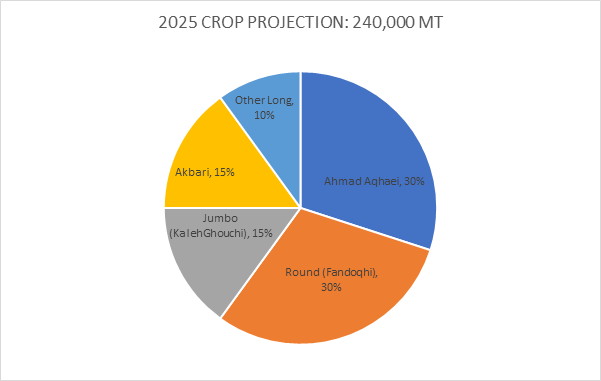

Projected 2025 Iranian Pistachio Crop & Variety Distribution

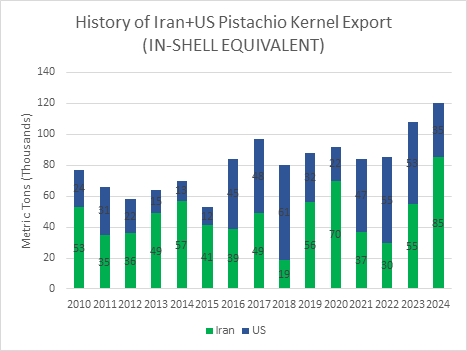

Share of Iran & US Pistachio Exports to the Far East

September 2024 – June 2025 (IN-SHELL EQUIVALENT)

No Caption

No Caption

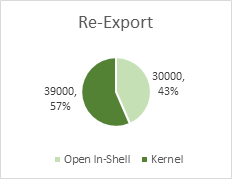

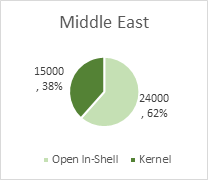

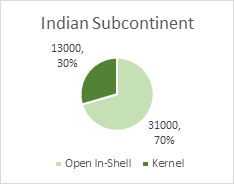

Iranian Pistachio Kernel Demand Drivers

Strong global demand for Iranian pistachio kernels:

- Exceptional Variety/Diversity/Range (Size, Color)

- Higher oil content, hence better roastability

- Competitive prices (high yield/meat-content)

- Limited supply from other origins (lucky for us, our colleagues mostly produce open-shell and lacks the farming know-how in producing more percentage of closed-shell (

Main Kernel Markets:

- The EU, Middle East, India

- Expanding demand in other markets, including China

Rise of Pistachio-Based Innovations

A variety of pistachio by-products being produced and sold globally

- Pistachio Paste, Spreads and Fillings

- Pistachio Latte

- Pistachio Milk

- Pistachio Oil (Food & Cosmetics)

- Pistachio Sauce

Kernel Consumption Trends

Iranian pistachio kernels:

- Ingredient in food and bakery industries & healthy snacking

- Roasted flavored kernel

- Dubai Chocolate Phenomenon

Dubai Chocolate Phenomenon

- Dubai Chocolate’s viral success: inspired similar pistachio-based product launches worldwide (generics)

- Ongoing influence on confectionery innovation, fashion industry, luxury collections and everyday life!

- Boosted awareness and demand for Iranian pistachio kernels and Green-Peeled Pistachio Kernels (GPPK)

Production

- Expansion of production across 27 provinces in Iran

- Gradual increase in production (compensating for decreased yield of legacy farms)

- Geographic diversity leading to reduced risks (climate, etc.) resulting in less fluctuations in production

- Continuing increase in share of Long Varieties

Processing

- Increasing Processing Capacity in new regions

- Improved quality & faster delivery times

- Shift to more technology-driven processing (Sorters)

Iranian Pistachios Market Trends

- China is and has been the bedrock of global pistachio consumption (establishing a price floor, hence giving assurance to pistachio farmers worldwide)

- Wise pricing strategies by our Californian colleagues, and lower opening prices (especially the bold 2023 opening price) helped the expansion of the Dubai Chocolate phenomenon, helping future price trends (from the opening price of less than $7 a kilo to prices of more than $9, helping an increase of ~30%)

- This shift in trend may result in increased demand for higher quality open inshell pistachios, of-course at a premium

- For price-sensitive customers, the trend may be towards higher percentage of MO/AO from quality bigger-sized closed shells (18-26)

Iranian Pistachios Opening Price Challenges

- The prices of Iranian pistachios differ by variety & size

- There is an Over-competition among Iranian exporters to China

- The importance of financing and exchange rate trend in early season

- The above situation makes fixed opening prices impossible in any crop season for Iranian pistachios

- California dictates the Opening Price (crop size of 3x Iran’s)

- Currently, Iran-China Pistachio-trade is mostly done in USD

- 25-year Iran-China partnership: Lobbying for RMB/Yuan-based settlements (CNY/CNH)

- Similar mechanisms are already in place between Iran & other BRICS countries: Russia and India

- Import Tariffs on Iranian Raw In-Shell Pistachios: China: 5% vs. EU: 1.6%

- Moving towards Iran-China Preferential/Free Trade (or lowering of import tariffs on Iranian pistachios)

Source: Iran pistachio