Pistachio Kernels: Iran’s Key Advantage in Global Markets

Behrouz Agah of the Iranian Pistachio Association emphasized at the INC Pistachio Roundtable:

“Pistachio kernels are Iran’s trump card in foreign markets. For the first time in over a century, Iranian pistachios have achieved significant international standing and are now selling well around the world.”

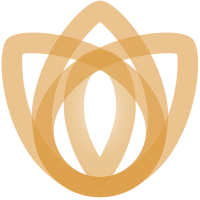

Domestic consumption versus exports

According to the latest sales report:

- Domestic consumption (first 7 months): 22,000 tons (10%)

- Exports (first 7 months): 147,000 tons (64%)

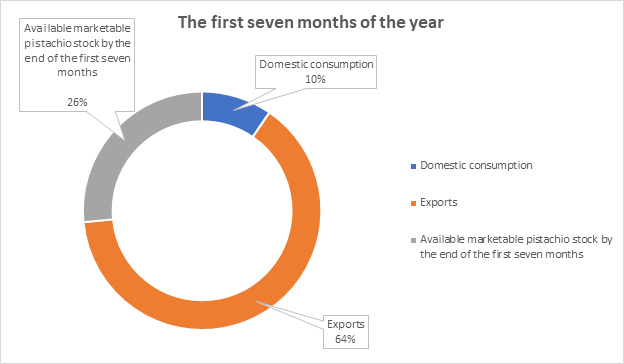

For the entire crop year, forecasts show:

- Domestic consumption: 30,000 tons (13%)

- Exports: 180,000 tons (78%)

- Stock: 20,000 tons (9%)

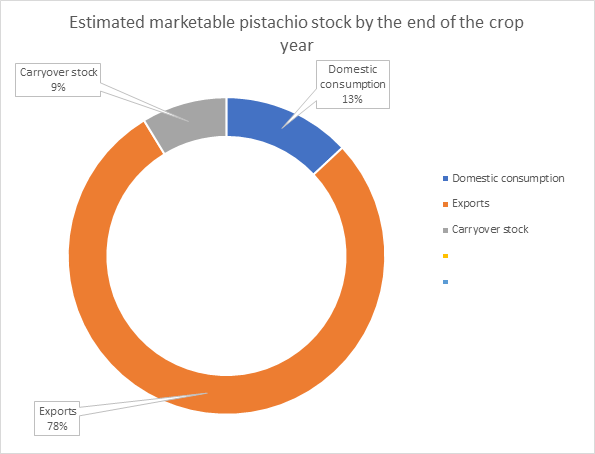

Product estimation

The Iranian Pistachio Association has estimated the new crop at around 220,000 tons. Of this amount:

- 40% will be round types (hazelnut model, goat head).

- 60% will be elongated types (such as Akbari, Ahmad Aghaei).

Despite weather-related challenges such as frost and heat, this remains the preliminary estimate for the upcoming harvest.

Export Market

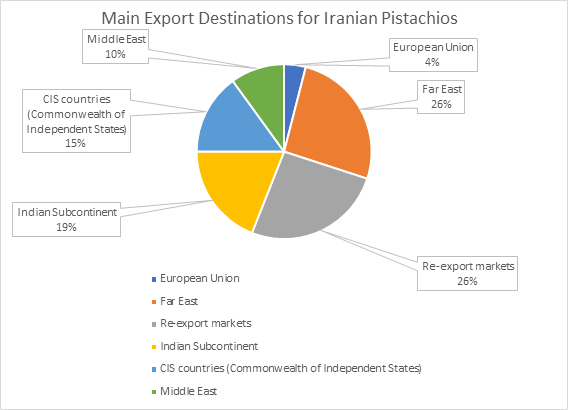

Iranian pistachios reached various global markets:

- Far East: 26% (largest market)

- Turkey and UAE (re-export hubs): 26%

- Indian Subcontinent: 19%

- Commonwealth of Independent States: 15%

- Middle East: 10%

- European Union: 4% (mainly pistachio kernels and green-shelled pistachio kernels)

Global competition

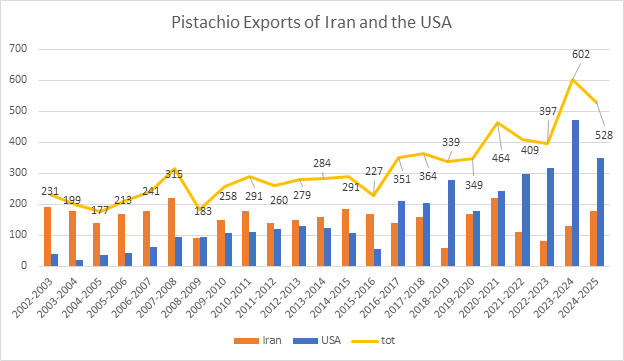

Last year, when the United States experienced a lean season, total pistachio exports worldwide reached 602,000 tons.

- If the United States faces another poor harvest this year, and given that Iran produces about 200,000 tons of pistachios annually, global pistachio exports are expected to total about 525,000 tons.

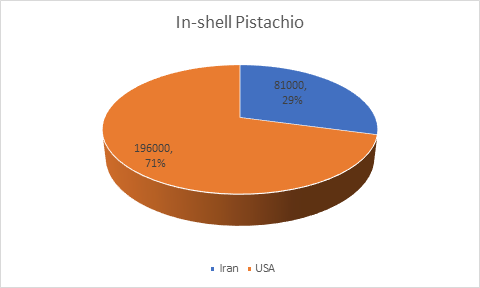

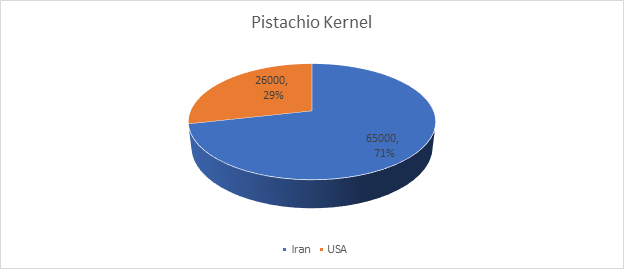

The comparative table of Iranian and United States exports shows:

- United States: Leading in pistachio shell exports

- Iran: Still leading in pistachio kernel exports

Expert insights

Mia Cohen:

“This is quite remarkable. Why is Iran leading in pistachio kernels, while the United States is leading in shelled pistachios? Will this trend continue?”

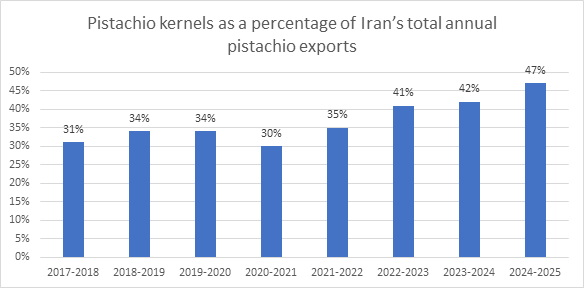

Behrooz Agah:

“One of the main reasons is the higher yield of Iranian pistachio kernels – about 10 percent more than American pistachios. If shelled pistachios are sold at the same price, producing kernels from Iranian pistachios is more cost-effective.”

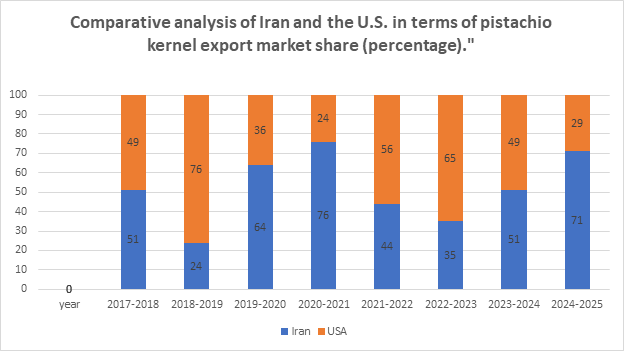

Another factor this year was the shortage of American pistachio kernels. This situation will not last forever. Other countries, such as Turkey, may eventually enter the competition. Currently, the market is shared between Iran and the United States, but this situation could change in the future.

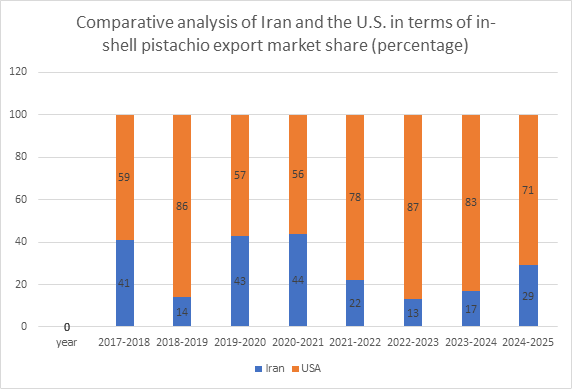

Long-Term Trends

The final chart shows the share of pistachio kernel and shelled pistachio exports from Iran and the United States over the past 8 years, along with current 12-month estimates.