Primex Report on US Pistachios – June 2025

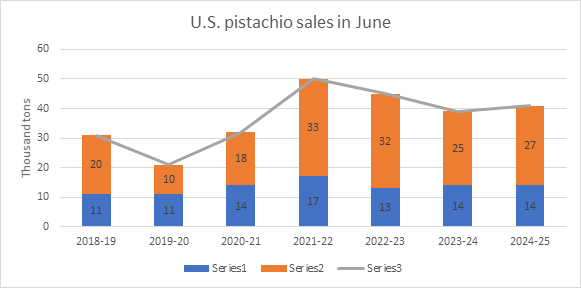

In June 2025, the tenth month of the 2024/25 marketing year, actual US pistachio sales reached 40,370 tons of in-shell pistachios. This represents a 4 percent increase from June last year but an 11 percent decrease from June 2022/23.

Of this total, 13,608 tonnes were consumed domestically and 26,762 tonnes were exported. Domestic sales were roughly the same as last year but 4% higher than June 2022/23. Exports increased by 7% compared to last year, although still 17% lower than June 2022/23.

Ten-month performance (September – June)

- Total sales: 432,723 tons → 18% decrease compared to last year, 8% increase compared to 2022/23

- Domestic sales: 128,367 tons → 2% less than last year, 3% more than 2022/23

- Exports: 304,360 tons → 23% decrease from last year, 10% increase from 2022/23

While June sales were up 4% year-over-year, total sales for the 10-month period were 18% below last year’s pace. This slight monthly growth reflects continued strong demand that is still outpacing supply.

Stock market outlook

Ending stocks in June were 26% lower than a year earlier, putting pressure on the market. Stocks are forecast to reach 620,000-680,000 tonnes by the time the new product is launched, indicating a challenging period for short-term and cash buyers.

Most of the US pistachio volume has already been delivered under contract, leading to inventory shortages in both origin and destination markets.

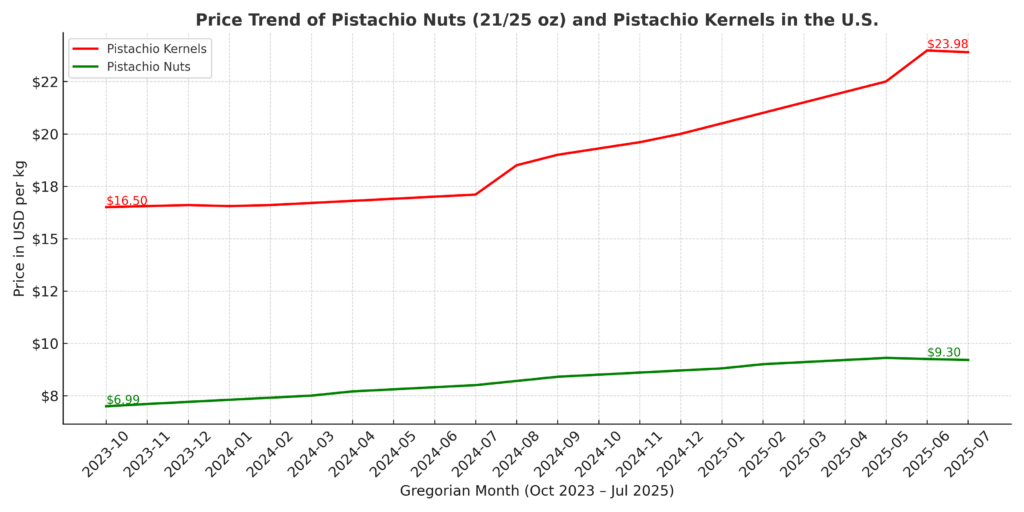

Price Trends

- Pistachios with skin: The price of shelled pistachios decreased slightly (about 10 cents per kilo)

- Nuts: Prices have remained stable due to strong demand, especially from the confectionery industry.

Agricultural Products Outlook 2025

The US pistachio crop is estimated to be 680,000 to 725,000 tons in 2025. Orchard conditions in California are reported to be excellent, with both Kerman and Golden Hills pistachio varieties developing their kernels well.

Although some of the Golden Hills orchards that did not have enough cold showed irregular yields, the rate of hollowing was lower and the filling of the brain was progressing towards maturity.

Favorable July weather and low pest pressure also point to a promising crop, although it is still too early to determine the final quality.

Export prices (FAS California)

- US No. 1 Open-mouthed Pistachios, 18-22 years: up to $9.60/kg

- US No. 1 Open-mouthed Pistachios, 21-27 years: up to $9.40/kg

- Pistachio kernels (May sale): around $24.20/kg

Comparison of monthly and cumulative sales of US pistachios compared to last year

Equivalent to dry skin (Ton)

| Monthly | Cumulative | ||||||

| Percentage Change | 2024-2023 | 2025-2024 | Percentage Change | 2024-2023 | 2025-2024 | Cumulative Share of Destinations | Export Destinations |

| 0% | 13,769 | 13,757 | -2% | 131,583 | 128,468 | 30% | U.S. Domestic Consumption |

| -13% | 8,378 | 7,253 | -35% | 184,979 | 120,207 | 28% | Asia |

| 40% | 10,110 | 14,198 | -3% | 122,492 | 118,323 | 27% | Europe |

| -22% | 4,065 | 3,173 | -31% | 64,692 | 44,394 | 10% | Middle East / Africa |

| -20% | 2,172 | 1,727 | -10% | 19,571 | 17,620 | 4% | Canada and Mexico |

| 26% | 361 | 454 | -20% | 4,782 | 3,805 | 1% | Others |

| 4% | 38,855 | 40,563 | -18% | 528,099 | 432,816 | 100% | Total |

California pistachio production, sales, and crop residues

Equivalent to dry skin (Ton)

| 2024-2025 | 2023-2024 | 2022-2023 | 2021-2022 | 2020-2021 | |

| Previous year’s carryover | 110,111 | 89,565 | 184,665 | 128,825 | 65,348 |

| Production | 503,230 | 677,095 | 401,039 | 529,244 | 476,332 |

| Total Available Product | 613,341 | 766,660 | 585,704 | 658,069 | 541,680 |

| Losses | 48,733 | 55,688 | 24,417 | 36,121 | 43,715 |

| Total Available Product | 564,608 | 710,972 | 561,287 | 621,949 | 497,965 |

| Total Sales | 501,952 | 600,861 | 469,844 | 437,284 | 369,140 |

| Year-end Stock | 62,657 | 110,111 | 89,565 | 184,665 | 128,825 |

| Year-End Stock as a Percentage of Total Available Product | 11% | 15% | 16% | 30% | 26% |

* June Estimates

Referance: Primex, Iran Pistachio Association